Hey ya’ll- It’s the classic startup fairytale:

You raise a million dollars off a deck.

You hire a lean team.

You build.

You launch.

And then… flatline.

Not because your product is bad.

But because you built it before knowing who it's really for, or why they’d even care.

Let’s be honest: Funding before Product-Market Fit (PMF) has become a startup epidemic.

And while it might look like success on TechCrunch, it often sets fire to the very foundation you're trying to build.

Today I’m breaking down:

Why early-stage funding without PMF often leads to a slow death

How to spot false signals

How to build momentum that lasts, with or without VC money.

The PMF Trap – Why Chasing Funding Before Fit Can Break You

The Allure of Early Funding

It’s easy to see why founders chase funding before PMF:

Validation from investors feels like validation from the market.

Capital provides breathing room hiring, experimenting, marketing.

It’s easier to raise when you’re “hot” than when you're heads-down.

But here’s the uncomfortable truth: investor belief ≠ customer demand.

PMF is not a pitch deck.

It’s not a waitlist.

It’s not hype on Twitter.

PMF is when users say: “I’d be upset if you took this away.”

And most startups don’t have it before their first raise.

What PMF Actually Looks Like

Here’s how Marc Andreessen, who coined the term, puts it:

"You can always feel when product-market fit is happening.

The customers are buying the product just as fast as you can make it."

But what if you're not there yet?

Instead of burning runway on top-tier hires and scale tactics, you should be obsessed with one thing:

Solving one painful problem for one type of customer so well, they tell others.

Here’s what that feels like:

Your inbox has more user feedback than investor intros.

People use your product despite bugs or janky UX.

Retention is climbing.

You’re not selling hard… people are pulling it from you.

The PMF Funding Trap: Why Startups Implode

Funding before PMF is like putting rocket fuel in a paper plane.

Instead of lift-off, it burns out mid-air.

Here’s how that usually plays out:

Premature Hiring:

You onboard sales, marketing, and ops before nailing the core value. They spin their wheels trying to “scale” something unproven.Flawed Metrics:

Vanity KPIs get presented to investors: website visits, signups, or MRR spikes, often disconnected from long-term user love.Pressure to Grow Too Fast:

Now you’ve raised money, you're expected to grow. Suddenly, you're pushing acquisition instead of understanding retention.No Space to Pivot:

When things don’t work, you have little runway left and investors lose faith.

End result?

An expensive lesson in entropy.

Because money amplifies what’s working, but it also amplifies what’s broken.

Real-World Case Studies

Case 1: Color Labs

Raised: $41M pre-launch

PMF status: Unclear

Outcome: Shut down within 18 months

Color raised a war chest without a working product. They had cash and press, but users didn’t “get it.” Despite a top-tier team, the lack of user traction meant no retention… and no redemption.

Case 2: Notion

Funding: Self-funded for 3 years

PMF status: Obsessive product iteration pre-launch

Outcome: $10B+ valuation, millions of loyal users

Notion stayed lean. They iterated slowly, directly with their community. They launched late, but when they did, they exploded, not because of hype, but because of habit.

So When Should You Raise?

Here’s a simple rule of thumb:

Don’t raise to find PMF. Raise to fuel it.

Before you raise, ask:

Do users come back without reminders?

Are they referring others organically?

Are they using the product in unexpected, creative ways?

Do we deeply understand the “why” behind their usage?

If the answer is “kinda…”, you’re not there yet.

And that’s okay.

In fact, the most powerful thing you can do before raising is fall in love with the problem, not the pitch deck.

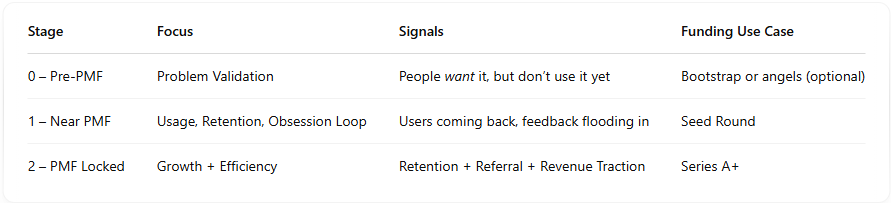

Framework: The 3 Stages of PMF Funding Readiness

Use this as your compass—not the hype cycle.

What to Say to Investors When You're Not "There Yet"

Founders often feel pressure to pretend PMF when talking to VCs.

But the best investors smell it a mile away.

Instead, be radically honest and position it like this:

“We’re heads down with 100 early users. We’re iterating fast, and our retention just improved 30% in 2 weeks.

We’ll raise once we can prove we’re not just a vitamin, but a painkiller.”

This builds trust, credibility, and intrigue.

Smart VCs respect founders who respect the craft of building.

Bottom Line:

VC funding is a tool, not a trophy.

Use it to scale pull, not push demand.

The real flex isn’t raising money.

It’s building something people can’t live without, even if only 100 people feel that way right now.

Product-market fit is hard.

But chasing funding before finding it?

That’s like skipping the map and hoping you land on treasure.

Are you building toward PMF right now?

What’s been your “aha” moment or your biggest challenge?